Table of Contents

- Weekly Updates (W2/2024): Deployment Plan – Đừng chỉ điền vào chỗ trống

- DOD เฮ..! ผถห.ไฟเขียว ออก W-2 เล็งสยายปีกกัญชง-กัญชา-พืชกระท่อม - Siam ...

- What Is Dd Mean On W2

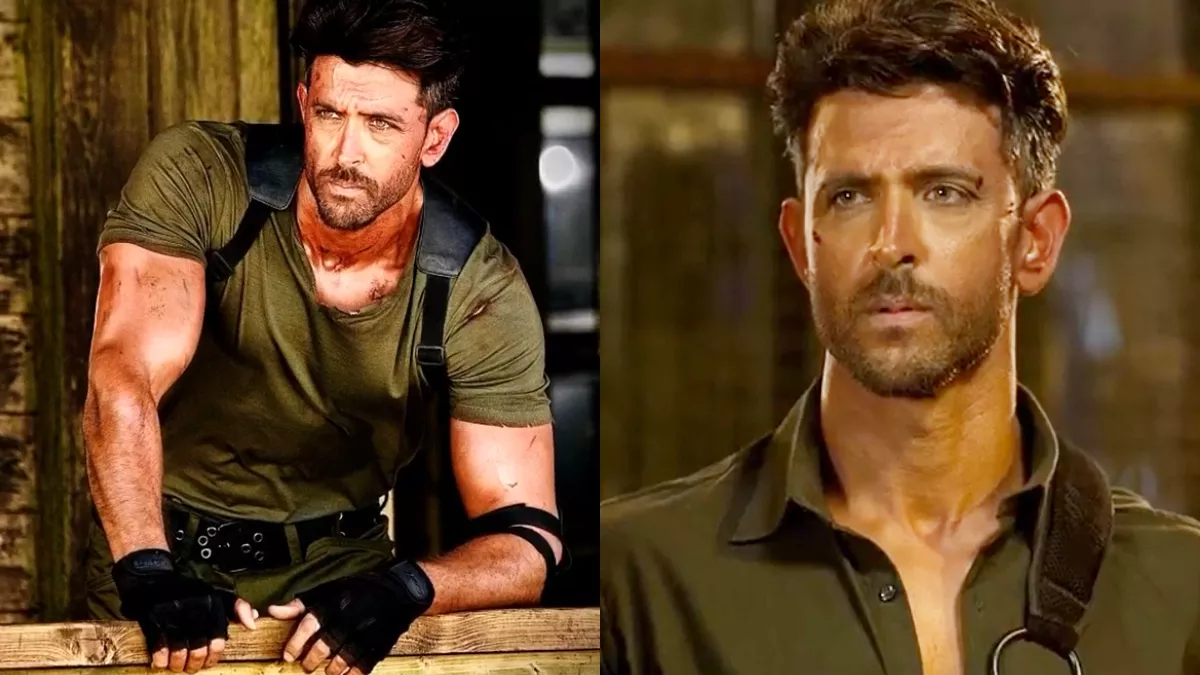

- ‘War 2’ sets its release date for Aug 14, 2025 - OrissaPOST

- safari-dod-27-05-2025-2 | Qatar i Discounts

- W2 - YouTube

- Call of Duty until 2025: Advanced Warfare 2 & Balck Ops 5 Coming

- ^w^(2) - YouTube

- ARM 2025 Q2 earnings call (Subtitle Translation) - moomoo Community

- DOD 2025 Budget Submission disarms America - Armed Forces Press

Introduction to DFAS

Tax Information for Military Members

Resources and Services

DFAS offers a range of resources and services to support military members with their tax obligations. These include: Tax Consulting Services: DFAS provides tax consulting services to help military members navigate the complexities of tax law. From answering questions about tax forms to providing guidance on tax planning, DFAS tax consultants are available to provide expert advice. Tax Forms and Publications: The DFAS website offers a range of tax forms and publications, including the W-2, 1099, and tax instruction guides. Military members can access these resources online, making it easy to file taxes and claim benefits. Taxpayer Assistance: DFAS provides taxpayer assistance to help military members resolve tax-related issues. From answering questions about tax debts to providing guidance on tax audits, DFAS taxpayer assistance is available to support military members every step of the way. In conclusion, the Defense Finance and Accounting Service is a vital resource for military members seeking to understand their tax obligations. From providing guidance on tax filing requirements to offering tax consulting services, DFAS is committed to supporting military members with their tax needs. By taking advantage of the resources and services offered by DFAS, military members can ensure a smooth and stress-free tax experience, allowing them to focus on their critical mission of defending our nation.For more information on tax information for military members, visit the DFAS website today.