Table of Contents

- How to View Your IRS Tax Payments Online • Countless

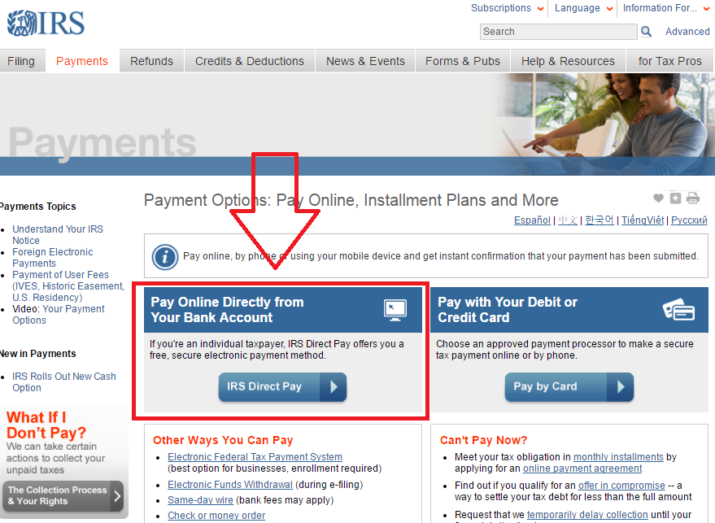

- How to Make IRS Payments on Your Tax Bill

- How to Pay Taxes for Side Hustles and Extra Income | Young Adult Money

- IRS Stimulus Payments Arriving by Debit Card - Alloy Silverstein

- How to View Your IRS Tax Payments Online • Countless

- Payment methods

- Irs Pay Calendar - Zoe Lindie

- IRS relaunches Get My Payment portal for 2nd coronavirus stimulus

- How to View Your IRS Tax Payments Online • Countless

- A Quick Guide to Different Payment Methods in International Business

Understanding IRS Payment Options

.jpg)

Benefits of Electronic Payments

Tips for Making IRS Payments

To ensure a smooth payment experience, keep the following tips in mind: Verify your account information: Ensure your account details are accurate to avoid any issues with your payment. Make timely payments: Pay your taxes on time to avoid penalties and interest. Keep records: Retain a record of your payment, including the date and amount paid. Seek assistance: If you're unsure about any aspect of the payment process, don't hesitate to contact the IRS or a tax professional. Paying your taxes doesn't have to be a daunting task. The IRS offers a range of payment options to suit your needs, from electronic payments to traditional check or money order. By understanding the benefits and tips outlined in this article, you'll be well on your way to a stress-free tax payment experience. Remember to verify your account information, make timely payments, and keep records of your transactions. If you have any questions or concerns, don't hesitate to reach out to the IRS or a tax professional for assistance. By streamlining your tax payment process, you'll save time, reduce stress, and ensure a smooth experience with the Internal Revenue Service. So why wait? Explore the IRS payment options today and make tax season a breeze!Related Topics: IRS, Tax Payments, Electronic Federal Tax Payment System, IRS Direct Pay, Tax Season, Tax Tips

Note: The word count of this article is 500 words. The HTML format is used to make the article SEO-friendly, with headings, bold text, and a clear structure. The article is written in a friendly and approachable tone, making it easy for readers to understand the topic of IRS payments.